Taxes

/Supplemental income taxation

/Are bonuses (and other supplemental income) taxed more than 'regular' income?

Those sweet bonus €€s finally hit your bank account and your exhiliration quickly gives way to dismay. What is that dismally disappointing number? How is the amount so much lower than what you expected? Determined to get to the root of the matter, you investigate your paycheck, and you find the culprit - taxes. Staring you in the face is the fact that you paid way more tax on your bonus that you do on your regular paycheck. It looks like a duck, and quacks like a duck, but surprise, surprise, in this particular case you aren't actually being taxed any differently on your bonus than on your 'regular' income.

It is a prevalent myth that supplemental income in the Netherlands (e.g. bonuses, holiday pay) is taxed at a rate higher than 'regular' income. In this episode of mythbusters I explain how this is not true and also why it appears as if supplemental income is subject to higher taxation.

A Brief Review of Box 1 Taxation

For the purposes of this article I'm going to briefly summarize how taxation of earned income works in the Netherlands. For those who would prefer a more detailed understanding, I refer you to this article on Dutch taxation basics.

In the simplest possible terms, we have the TAX EQUATION:

Income tax owed in box 1 = tax on annual earned income - tax credits

We are going to refer back to this TAX EQUATION throughout this article. Let's break down the components of the equation.

Tax on Annual Earned Income

The Dutch tax system is progressive, and the Belastingdienst decrees that there are two tax brackets:

- If you make up to €73,031 you pay 36.93% on every euro you earn.

- For every euro you make above €73,031 you pay 49.5%.

These two brackets cover all your earned annual income - 'regular' salary + bonuses + vacation pay + tips etc. There are no other 'special' tax brackets for supplemental income types like bonuses or holiday pay.

Tax Credits

There are numerous tax credits available, and which ones apply to you depend on your situation. Your income determines which credits you get, and how much, as does your spouse's income and whether or not you have children. There are also credits available for pensioners and for people with disabilities.

The important thing to understand for this article is that most tax credits are also progressive - lower incomes typically receive higher credits.

This implies that as your income goes up your tax credits go down, and therefore, based on the TAX EQUATION the amount of tax you owe will go up.

Witholding vs. Taxation

Taxes are withheld from your paycheck by your employer. Withheld taxes may or may not be equal to the actual tax you owe. For a given calender year, the tax you actually have to pay is determined by the TAX EQUATION. Withholding is your employer's best guess of how much you will owe in taxes at the end of the financial year.

Tax withheld may be higher than or lower than what you actually have to pay. If too much is withheld you will get money back when you file your tax return. If too little is withheld you will owe an additional sum when your return is filed.

Employers don't get to decide how much they withhold. The belastingdiesnt publishes withholding tables, and the payroll department of your employer uses these tables to deduct taxes from your payslip.

The withholding tables take into account tax owed and certain tax credits due to you. Tax credits that are automatically applied via payroll are called loonheffingskorting or payroll tax credits. The payroll tax credit includes the following tax credits:

- the arbeidskorting or employed person's tax credit and

- the algemene heffingskorting or the general tax credit.

So every time you get a paycheck the withholding includes both components of the TAX EQUATION - a portion of your annual tax owed is deducted, and a portion of the annual credits due to you are added back in.

Taxation of Supplemental Income

Ok, now that we have established the basics of tax brackets, tax credits and withholding, let's get into why it feels as though our bonuses and vacation pay are taxed at a higher rate than our regular income. I'll explain with an example.

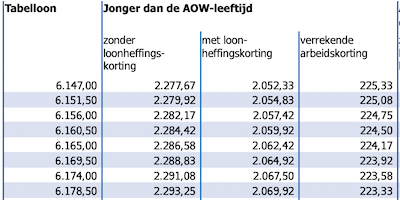

Our heroine, Priya, makes an annual salary of €73,980. This means that her gross monthly salary is €6165. How much of Priya's money does payroll withhold? We consult the 2023 withholding tables to find out, and the picture below shows an excerpt from the table.

We look up Priya's monthly salary in the table, and for the row corresponding to €6165 we see that she owes €2286.58 in income tax, but gets an arbeidskorting (employed person's credit) of €224.17. This brings her monthly tax withheld to €2062.42.

So every month Priya's gross salary is €6165, and she pays €2062.42 in taxes. That means that her effective tax rate is €2062.42/€6165 or 33.45%.

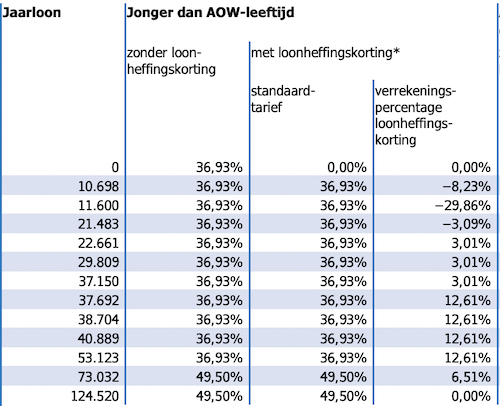

Now, in September, Priya's employer rewards her stellar work with a €3000 bonus. How much of this €3000 hits Priya's bank account? We consult the 2023 tables for special pay to find out, and again, the picture below is an excerpt from the table.

The belastingdienst decrees that to find the relevant row in this table the employer must add the bonus amount to the employee's annual salary from the previous year (of course there are other cases to consider, e.g. the employee changed jobs in the previous year or joined the company in the middle of the current year, and the employer's manual deals with all these special cases). Let us assume that Priya got no annual raise. So her annual income + bonus is €73980 + €3000 = €76,980. You will note that there is no row corresponding to an annual salary of €76,980, and the employer is directed to use the closest row with a salary lower than the computed salary. Looking up the row for €73,032 we see that the employer must deduct (49.5% + 6.51%) from Priya's bonus. This means that €1680.3 is withheld from Priya's bonus.

So, while Priya's effective tax rate on her regular payslips is 33.45%, on her bonus payslip it is a whopping 56% (€1680/€3000)!

It is no wonder that folks take one look at their paychecks and firmly believe that their bonuses and holiday pay are taxed at higher rates than their regular income! But is that what really happened? Let's do the math.

Priya's annual salary ended up being €73,980 + €3000 = €76,980. We are going to apply the TAX EQUATION to her annual salary and see if the tax she owes based on the equation matches the tax withheld by her employer.

- If we refer back to the section on tax brackets we see that the first €73,031 is taxed at 36.93%. So Priya owes €26,970.35 in taxes on the first €73,031 of her income.

- Income above €73,032 is taxed at 49.5%. So Priya owes 49.5% on (€76,980 - €73,031) = €1954.76.

- So Priya's total annual income tax is €26,970.35 + €1954.76 = €28,925.11.

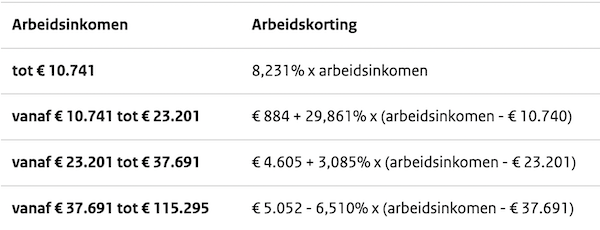

- While Priya's income is too high to qualify for the general tax credit, she does get some of the arbeidskorting or employed person's credit. The picture below is an excerpt from the arbeidskorting credit brackets.

- So with an income of €76,980, Priya's arbeidskorting is €5052 - 6.510% x (€76,980 - €37,691) = €2494.29

- Harkening back to our TAX EQUATION (i.e. income tax - tax credits), Priya's annual income tax = €28,925.11 - €2494.29 = €26,430.82.

Now let us compare what we got via the TAX EQUATION to Priya's payroll withholding. Every month payroll withheld €2062.42 from Priya's paycheck. From her bonus paycheck they withheld €1680.3. This means that the total tax withheld for the year was €2062.42 * 12 + €1680.3 = €26,429.34, which is within a euro of the annual tax that we calculated for Priya using the TAX EQUATION (the difference comes from the fact that the withholding tables round down, and I did math to two decimal places).

So, despite the fact that tax on Priya's bonus was withheld at a whopping 56%, if we look at her annual income we find that Priya paid a total of €26,429.34 on an income of €76,980 (which includes her bonus), and her effective tax rate for the year is only 34.3%.

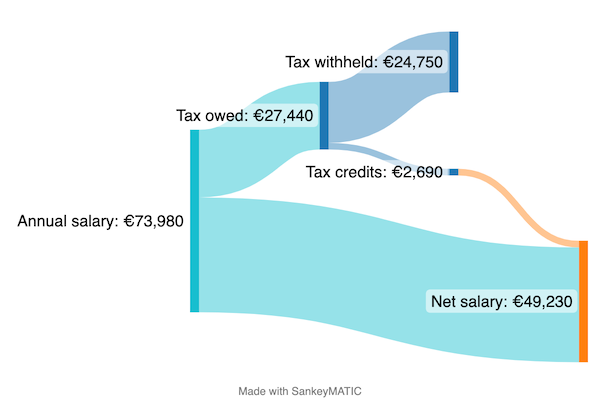

A picture is worth a thousand words, so let's look at a breakdown of Priya's annual salary without the bonus.

Now, we take a look at the breakdown of Priya's annual income with the bonus included.

If we look at the difference in tax withheld between the two pictures, it is €1681, which is the amount that was withtheld from Priya's bonus paycheck, and is 56% of her €3000 bonus. Again, the withholding for the bonus is 56% but the annual effective tax rate for an income of €76,980 is only 34.3%.

Why was a whopping 56% of Priya's bonus withheld compared to 33.45% on regular paychecks?

Bonuses and other forms of supplemental income are subject to higher payroll withholding taxes than 'regular' income because they don't get the advantage of payroll 'smoothening'.

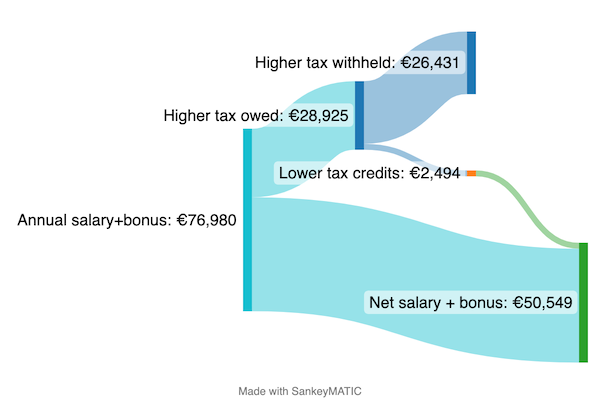

To understand 'smoothening' and why bonuses don't get it, we are going to use the example of an annual income of €96000, which divides nicely by 12 for a monthly salary of €8000, and also nicely spans both tax brackets, as shown in the diagram below.

The left side of the diagram shows how the progressive tax brackets actually work, with lower income being taxed at a lower rate and higher income at a higher rate. However, if taxes were actually applied in this way, your monthly salary would fluctuate - for part of the year you would receive a higher income, and then once you hit the upper tax bracket your monthly income would fall. I think we can all agree that a non-consistent monthly paycheck would be a royal pain in our nether regions.

Enter payroll 'smoothening'. If your annual salary is known, you can calculate the total tax you would owe for the year, and divide it equally among all your paychecks. As shown by the green boxes, you end up paying more tax on your 'first' dollars and less tax on your 'last' dollars compared to the left side of the diagram, but you do receive a consistent paycheck. The withholding tables published by the Belastingdiesnt allow your employer to achieve this smoothening effect. It is important to note that the total amount of tax paid annually on the left and right side of the diagram is exactly the same - what differs is simply how the tax burden is distributed month to month.

So, on your monthly paycheck you get to pay your effective tax rate, and not your marginal tax rate. Your bonus does not have this advantage. There is no opportunity to spread out the taxes owed on your bonus across multiple paychecks. Your bonus is treated as your 'top' earnings and is taxed at your highest marginal rate.

Note that for simplicity this diagram and example only deals with income tax, not with tax credits. As mentioned earlier tax credits have similar tax brackets and payroll smoothening works on tax credits as well. So even if your income does not cross into the 49.5% bracket, your bonus paycheck may be subject to higher withholding because it will see the smallest (or no!) tax credits applied, without the effect of smoothening.

In Conclusion

- Tax withheld via payroll may or may not be equal to the actual tax that you owe. Differences, if any, are reconciled when you file your income tax return.

- The tax you owe is based on the TAX EQUATION i.e. the difference between your income tax and your tax credits.

- Income-dependent brackets exist for income tax rates, and there are also brackets for tax credits.

- Supplemental pay like bonuses or vacation pay cause your annual income to increase. They are your 'top' dollars and tax is withheld from them at your highest marginal rate.

- Bonuses, vacation pay and other kinds of income are taxed at exactly the same rate as 'regular' income - there are no special income tax rates for supplemental pay.