Expat Tools

/Money Transfer

/How I transfered 6 figures from the US to the Netherlands for $94.99

June 2022

During the final stages of our move to the Netherlands from the U.S. I started to research ways to transfer money from the U.S. to the Netherlands as cheaply as possible. Wise (previously known as Transferwise) is oft-recommended in various blogs and forums. I checked out their fee structure, and was disgruntled. Yes, they were cheaper than a 'traditional' bank-to-bank transfer, but I begrudged them every penny. So, I dove back down into the murky depths of the internet, and was well rewarded for the time I spent there when I discovered a treasure called Revolut.

What is Revolut?

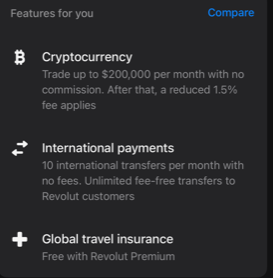

Revolut is a financial services startup that was founded in 2015. They offer banking services, debit cards that can be used fee-free worldwide, the ability to earn cash back, travel insurance and more. This post focuses on their fantastic ability to transfer money internationally at wondrously non-usurious rates.

- With a free Revolut account you can transfer $1000 to your Dutch bank for a grand total of $0 in fees. And you can do this 10 times a month. I stand by my decision in the previous paragraph to use an excess of adjectives to describe this feature.

- When you need to transfer more serious amounts across the ocean, as I did when I needed to move 6 figures when we were purchasing our home in Amsterdam, you will need a premium Revolut account - and that cost me $94.99 for a whole year worth of transfers.

Note that Revolut is not a bank - they partner with banks to provide certain banking services. In the U.S. the 'backing' bank is Metropolitan Commercial Bank, so that is the name that shows up in certain places (for example, when you enter the routing number in order to make an ACH transfer).

What do you need?

To transfer money from the US to the Netherlands you will need:

- A U.S. bank account that is the source of your funds (I've used both Bank of America and Schwab with my Revolut account).

- A U.S.-based Revolut personal account. You need to pay for a Premium account. This currently costs $9.99 a month. There is a discount if you pay for a whole year up front. I paid $94.99.

- A Dutch account. I use ING.

Note that you cannot have more than one Revolut personal account. So if you open a U.S.-based account, you will not be able to open an EU account in the future. I don't have the need right now to send money from the Netherlands to the U.S., but if I do, we'll open another account in my husband's name. If you do intend to transfer money both ways, and don't have a financial partner who can open another account, I would suggest following the steps listed in this blog post by Jessa Lyn. Note that for transfers from the U.S. to the Netherlands, you will be subject to daily and monthly limits if you use the method detailed in that blog post.

You can open a U.S.-based Revolut account even if you are resident in the Netherlands, but you will need access to a U.S. phone number to do so.

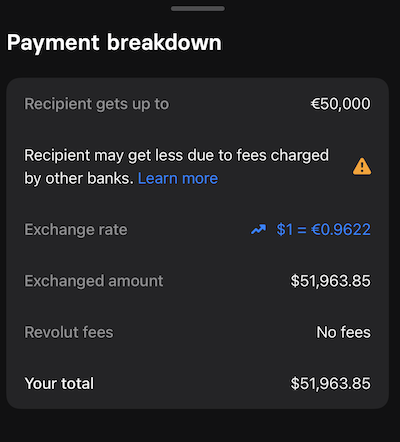

A Premium Revolut account gives you 10 international transfers a month for free. For U.S. dollars to Euros, they say that there is no limit on the size of the international transfer, other than limits imposed by any intermediary banks that they might need to use. I can confirm that I have transfered up to $100,000 in a single transfer.

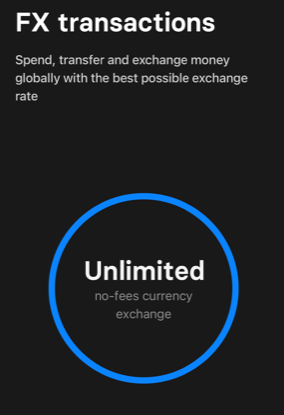

Also, there are no FX fees.

How to Transfer

Once you have the accounts all set up, transferring is simple:

U.S. account -----> Revolut ------> Dutch bank account

- Make an ACH transfer from your U.S. account to your Revolut account. You do this by logging into your U.S. bank and initiating the transfer. To do this you will need your Revolut account number and routing number. You can find these in the app. This transfer should be free because it is between two U.S. banks. This was the longest pole of the tranfer. From my Bank of America account to my Revolut account, the transfer took 5 business days. If you are in a hurry your bank will probably let you pay for a faster transfer. Revolut limits the size of a single ACH transfer to $100,000. I couldn't find this documented anywhere on their site/app, but I did confirm the limit by chatting with customer support.

- Once the money is in your Revolut account, you initiate a transfer to your Dutch account. Since you have paid for a Premium account, this transfer will also be free. This transfer took less than four hours to complete.

Here is an example of what it looks like to initiate a transfer from Revolut at the market exchange rate:

Gotchas

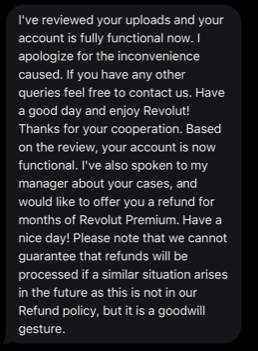

If you transfer a large amount of money internationally, money laundering prevention laws are going to come into play. In my case after my first large transfer, Revolut sent me a message saying that I needed to upload documents proving the source of my funds. I did this, but they did not verify my documents for over 48 hours. I pinged customer support multiple times to no avail. Luckily, I noticed that transfers were not blocked pending verification, so I continued making my transfers as needed. It took them nearly a month to verify the documents I had uploaded, and once they did they waived my Premium fee as an apology. So actually, I transfered 6 figures to the Netherlands for $0!

My only other complaint would be that the only way to contact their customer support is to message them using the chat function in the app. My experience was that there were very long wait times - I waited hours for a response every time I contacted customer support. Once I did manage to get ahold of suppport they were helpful and all my issues were resolved to my satisfaction.